Okay, let’s talk about this Harry Browne Permanent Portfolio thing. I know, I know, the name sounds fancy and intimidating, like something only Wall Street suits would understand. Honestly, that’s exactly what I thought when I first stumbled across it years ago. My investing journey has been… let’s call it adventurous, with lots of buying high, selling low, and chasing shiny objects. Feeling kinda worn out by the rollercoaster, I decided actually try this simple-sounding strategy for real. No promises, just sharing the messy journey.

Starting Point: Why Bother?

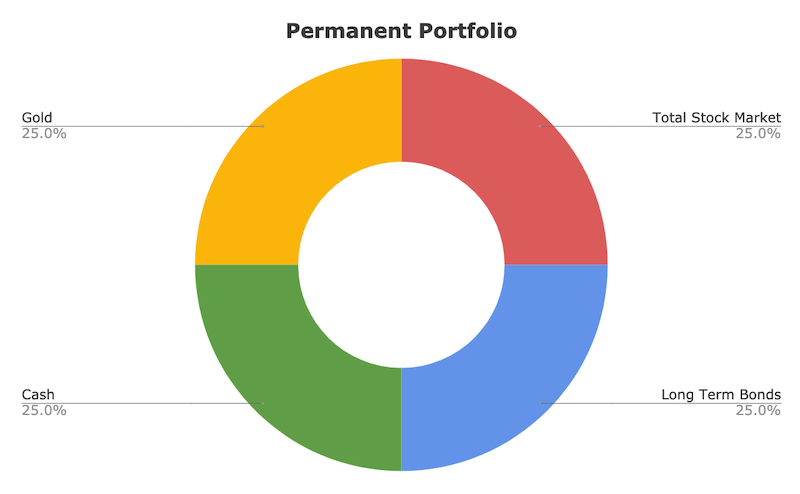

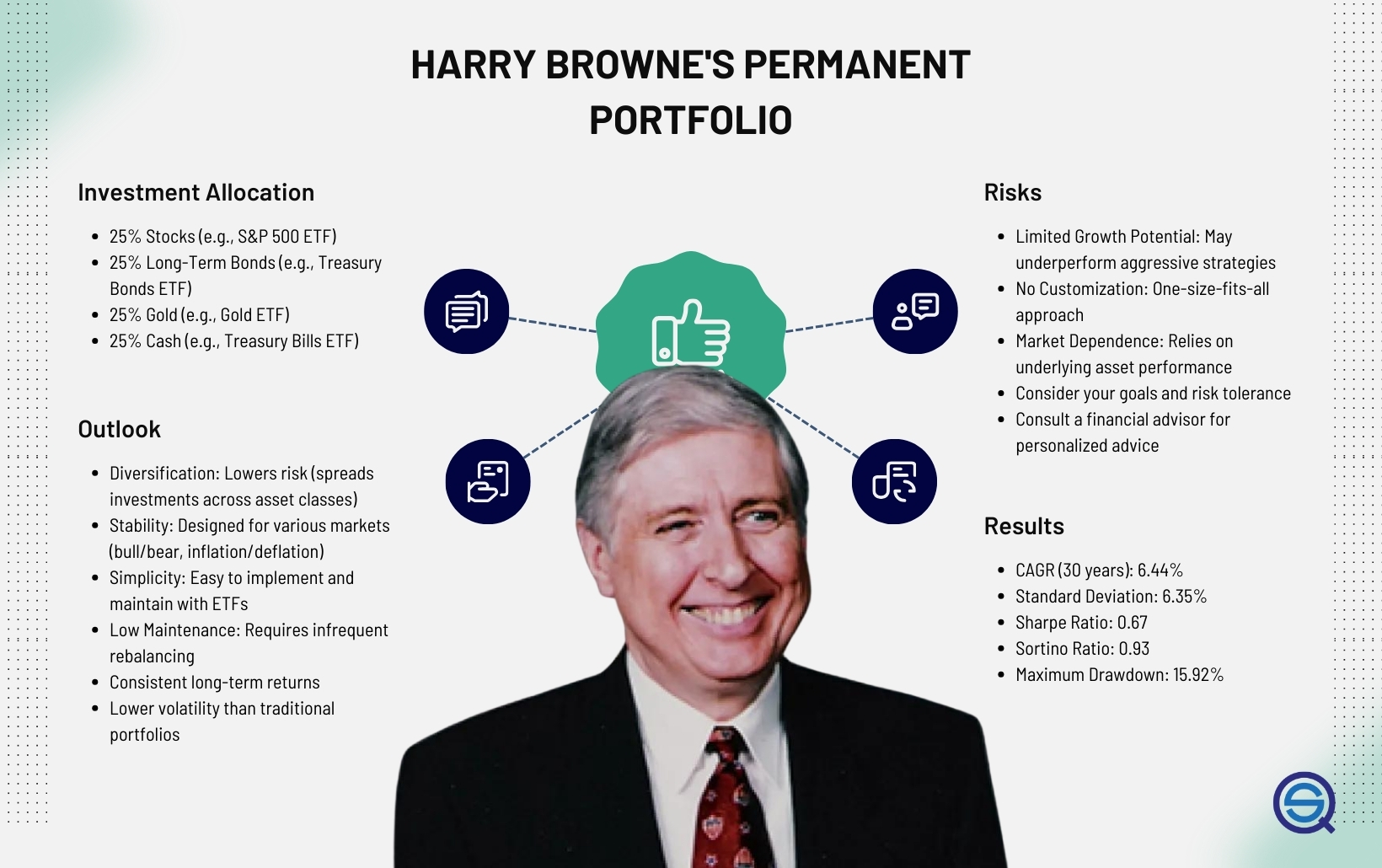

Right? Why listen to some guy named Harry? Well, the core idea hooked me because it made sense after a few market beatdowns left me feeling stupid. He basically said don’t try to predict what the market will do next – because you’ll probably be wrong. Instead, split your money evenly four ways to cover your butt no matter what:

- Stocks: For when times are good and the economy is growing.

- Long-term Bonds: For when times get tough (recessions) or people panic.

- Cash: For when nothing else works and everything is crashing. Also, ya know, for emergencies.

- Gold: For when governments print too much money and the value of cash drops (inflation).

It felt crazy putting gold next to US bonds! But the logic was that these four chunks react very differently to different economic weather. Hopefully, when one tanked, another would catch you. Seemed worth a shot to finally stop sweating every market dip.

Getting My Hands Dirty (The Setup)

This is where the “permanent” part felt weird. Browne meant set it and mostly forget it. For someone used to constantly checking and tweaking (read: meddling), doing nothing felt unnatural. But hey, that was the point! Less work sounded good.

So, here’s what I actually did:

- Grabbed my pile: Took a chunk of money I was willing to lock away for the long haul. Not the rent money!

- The Math: Seriously simple: Divided it by four. 25% each. Boom.

- Putting it in Place:

- For Stocks: Went super boring. A cheap ETF that tracks the broad US stock market (think the whole thing). No picking winners/losers.

- For Long Bonds: Found another cheap ETF holding long-term US government bonds. Remember, not fancy corporate bonds!

- For Cash: Started with just a high-yield savings account. Later explored Treasury Bills (super safe government IOUs you can cash quickly) for a tiny bit more interest.

- For Gold: Took some digging. Ended up using a major Gold Bullion ETF (like one holding actual bars in a vault). Not mining stocks! Physical gold exposure.

- Just Parked It: Then… I had to resist the urge to fiddle. Harder than it sounds!

The Waiting Game (And Rebalancing)

This is where it gets real. Markets do crazy stuff:

- Stock markets soared? Great! But my stock chunk became way bigger than 25%, messing up the balance and increasing risk. Had to sell some profits.

- Bonds crashed (like 2022)? Painful! Watching that bond slice bleed out was tough. When cash or gold did well (or the others fell enough), I had to buy more bonds while they were cheaper to bring it back to 25%. Felt totally wrong buying into a loser.

- Cash felt useless? Yep. Sitting on cash when stocks are mooning feels like an idiot move. You miss out on gains. But then a crash hits, and suddenly, being able to rebalance from cash without selling losses feels… kinda smart.

- Gold went nuts? Or died? Volatile. But watching it pop during periods of inflation fear, while stocks got crushed, was fascinating. Helped offset losses elsewhere.

The only action I took was once a year (yearly rebalancing). Looked at each chunk. If any was more than 35% or less than 15% of the total, I sold the winners that got too big and bought the losers that got too small. Brutal discipline. Sometimes it meant buying the absolute worst-performing asset that year. Ouch.

What Did I Learn?

After sticking with this for a few years (through good times and scary ones like 2022):

- Smooth is the Goal: It wasn’t about hitting home runs. My portfolio generally didn’t soar as high as the pure stock market in huge up years. BUT! It also didn’t crash nearly as hard during the really bad times. Sleep got better.

- Gold isn’t Scary: Turns out it behaves very differently than stocks or bonds, especially when everyone freaks out about inflation.

- Cash Ain’t Trash (Sometimes): Holding it feels terrible… until you need it to buy cheap assets during a fire sale. It’s a shock absorber.

- Discipline is HARD: Rebalancing is emotionally counter-intuitive. You will fight the urge to abandon it when one piece sucks. Stick to the rules.

- Boring Works (Maybe): For me, tired of the gamble, the stability and simplicity are worth the trade-off of not hitting crazy highs. It just… chugs along. Predictable. Weirdly calming.

Is it perfect? Nope! Some years you feel like a genius, others an idiot holding cash while stocks rip. But for a regular person like me, who wants something simple, diversified across different economic dangers, and doesn’t need constant babysitting… it’s become the core strategy I trust to just keep working without me stressing daily. It works precisely because it’s boring as hell. And sometimes, boring is beautiful.